We specialize in frozen poultry. Our offer includes frozen cuts and meats from: chicken, light and heavy hen, turkey, duck, goose and rabbit. We also offer raw materials for the production of pet-food: poultry, pork, beef and rabbit.

Our permanent offer includes:

- chicken breast fillet,

- chicken inner fillet,

- chicken leg meat without skin and with skin,

- chicken thigh meat without skin and with skin,

- chicken thigh,

- chicken drumstick,

- chicken wing,

- chicken carcasses,

- chicken grillers,

- chicken trimmings,

- chicken breast trimmings,

- chicken baader,

- Chicken MDM and chicken breast and leg skin.

In addition, we offer chicken offals packed in a polyblock or a naked block: chicken liver, gizzards and hearts, as well as short and long chicken paws and feet grade A and B.

We offer our products in various versions of freezing and packaging: IQF, naked block, polyblock, 15 kg carton, 10 kg carton and 5 kg carton. We also offer frozen products packed in vacuum.

In our offer you will also find a wide range of turkey products:

- turkey breast fillet,

- turkey inner fillet,

- turkey thigh meat without skin and with skin,

- turkey thigh,

- turkey drumstick,

- turkey wing,

- turkey wing meat with and without skin,

- turkey trimmings: light turkey meat, dark turkey meat, turkey breast meat, turkey breast trimmings A and B grade,

- turkey drumstick baader,

- turkey breast baader,

- turkey thigh skins,

- turkey skins B grade,

- Turkey MDM and Turkey necks.

We also trade with hen & rooster and its cuts.

Our offer includes products such as:

- light hen leg quarter,

- heavy hen leg quarter,

- light hen wing,

- heavy hen wing,

- light hen breast fillet,

- heavy hen breast fillet,

- whole light hen,

- whole light hen carcass,

- light and heavy hen paws and feet A and B grade.

We offer 10 kg cartons or polyblock packaging.

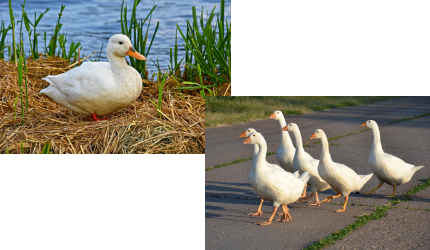

Our permanent commercial offer includes Peking and Barbarie ducks as well as Polish oat goose.

We offer: Pekin IWP duck, calibrated A, B and C grade, Pekin and Barbarie duck leg, Pekin and Barbarie duck breast, duck wings with bone and skin and deboned duck wing, duck carcasses, duck necks, as well as duck feet.

In the autumn season, we offer Polish oat goose and its cuts: Whole goose calibrated IWP, goose leg, goose breast skin on and bone in and goose fillet skinless boneless. In our offer you will also find duck and goose offals: liver, hearts and gizzards.

We work with leading rabbit producers.

We offer frozen: whole rabbit, deboned rabbit, rabbit leg. Packaging: vacuum and cartons.

In addition to a wide range of products used in the production and processing of food, we also specialize in trading raw materials for the production of pet-food. We offer poultry, pork and beef raw materials, as well as rabbit.

We can’t wait to hear what products you are looking for and how we can help you!